Samsung used to be the one primary reminiscence maker that didn’t reduce the output of DRAM and 3-d NAND when call for for those commodity ICs dropped because of softening of PC and smartphone gross sales closing 12 months. However as the corporate’s income plummeted in Q1 2023, it determined to cut back reminiscence manufacturing to stability the availability and insist state of affairs in the marketplace.

“We have now reduce non permanent manufacturing plans, however as we mission cast call for for the mid-to-long time period, we can proceed to put money into infrastructure to protected very important cleanrooms and to increase R&D funding to solidify tech management,” a observation via Samsung printed via Bloomberg reads.

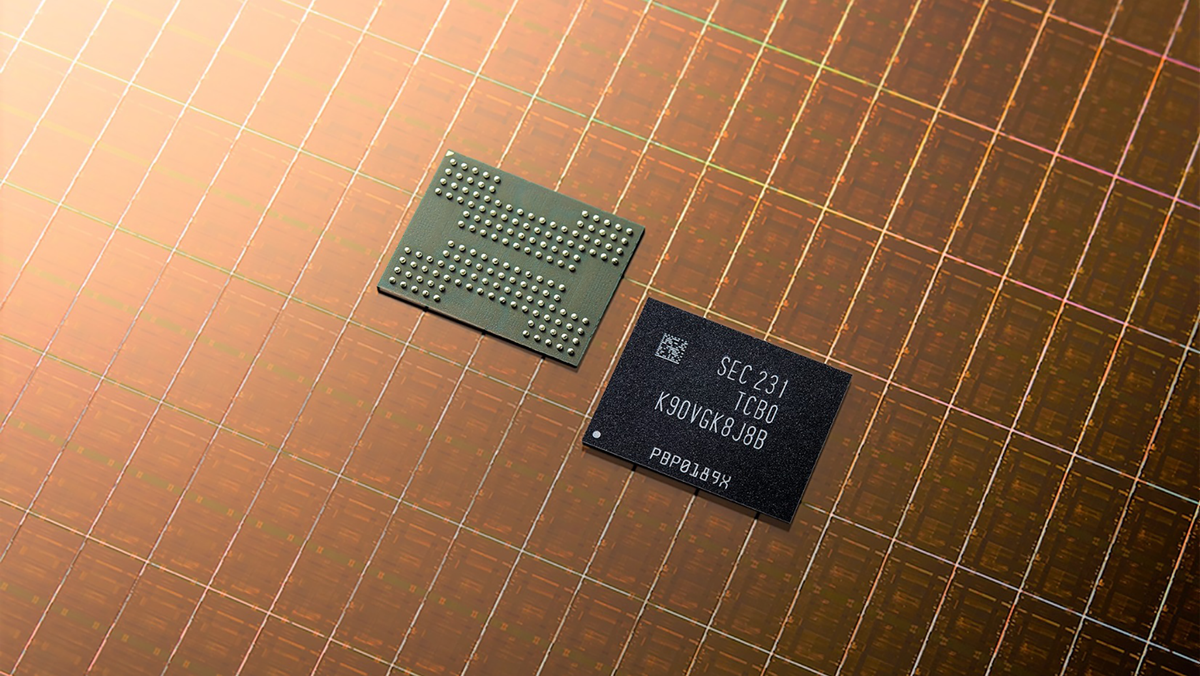

Samsung is the arena’s biggest provider of DRAM and NAND, and reminiscence gross sales considerably give a contribution to the corporate’s profits. The corporate commanded a 45.1% percentage of DRAM marketplace and a 33.8% income percentage of NAND marketplace in This fall 2022, in step with TrendForce.

Whilst the corporate officially said that it might reduce reminiscence manufacturing, it by no means printed how considerably it intends to cut back wafer begins and reminiscence bits output.

Maximum of Samsung’s competitors diminished reminiscence manufacturing on older applied sciences however endured to steadily ramp up reminiscence manufacturing on more recent fabrication processes. In most cases, the newest nodes lower chip prices and build up bit output in keeping with wafer, so in lots of instances, reminiscence ramp on more recent nodes greater than offsets manufacturing cuts on older nodes relating to bits output.

Alternatively, analysts consider that Samsung’s purpose to chop down reminiscence manufacturing will impact the call for and provide stability available in the market and can a minimum of decelerate the cave in of reminiscence costs in Q2 2023.

“Counterpoint expects that the usage price aid [will] decelerate the decline of commodity reminiscence costs,” Brady Wang, a senior analyst, instructed Nikkei Asia. “Nonetheless, this oversupply is because of weakening call for and prime stock, so Samsung’s manufacturing reduce isn’t anticipated to stimulate gross sales. Due to this fact, Counterpoint believes that the oversupply state of affairs will proceed till the 3rd quarter when the marketplace begins to dissipate stock for the fourth quarter seasonal call for.”

Samsung’s Q1 2023 income dropped to 63 trillion received ($48.877 billion), or 19% in comparison to the similar quarter a 12 months in the past. The corporate’s benefit collapsed to 600 billion received ($450 million), or via 95% year-over-year, falling in need of the 1.4 trillion received ($1.064 billion) moderate forecasted via analysts.

Supply By means of https://www.tomshardware.com/information/samsung-to-cut-3d-nand-and-dram-output